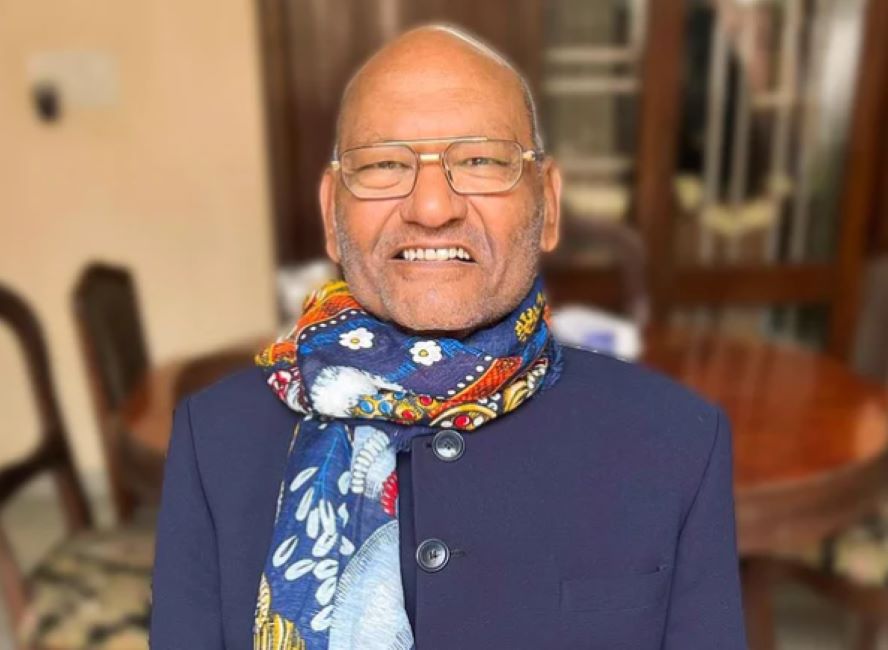

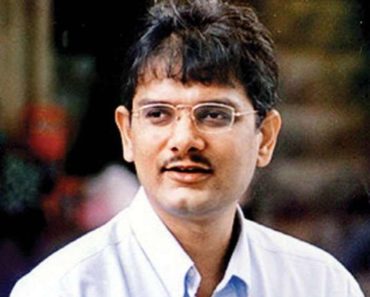

Anil Agarwal is an Indian businessman, philanthropist, and the founder and chairman of Vedanta Resources Limited. He is known professionally as the “Metal King”.

Contents

Wiki/Biography

Anil Agarwal was born in 1954 (age 69 years; as of 2023) in Patna, Bihar, India. Anil did his schooling from the Miller High School in Patna. [1]Business Insider After school, when he was 19, he moved to Mumbai instead of pursuing a degree to work for his father and explore his career options.

Physical Appearance

Height (approx.): 5′ 8″

Hair Colour: Black (Bald)

Eye Colour: Dark Brown

Family

Parents & Siblings

Anil Agarwal’s father, Dwarka Prasad Agarwal (deceased), was engaged in a business involving aluminium conductors. Anil Agarwal has two brothers, Pravin Agarwal who works closely with the Vedanta Group and Navin Agarwal, who holds the position of chairman at Cairn India (which is also in ties with the Vedanta Group). [2]The Economic Times

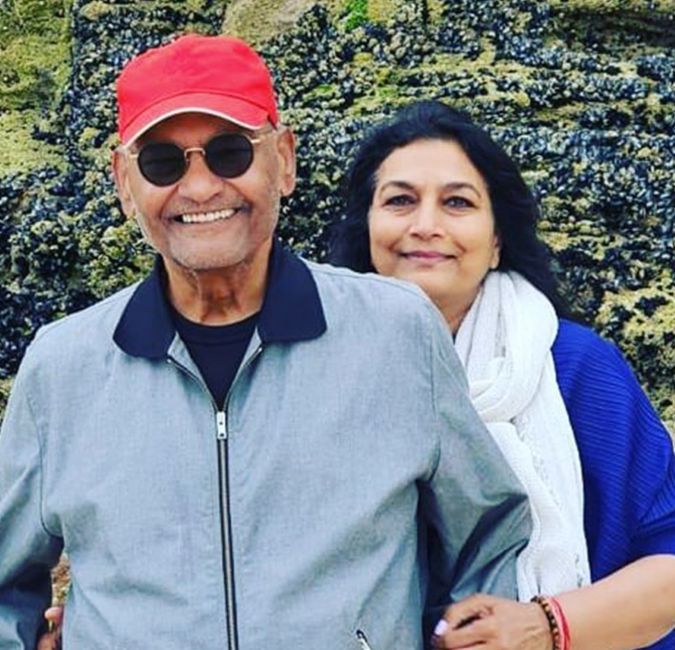

Wife & Children

Anil Agarwal’s wife, Kiran Agarwal, is an author, poet, and entrepreneur. She is the founder of Woka Creations and serves as the Chairperson of Hindustan Zinc Limited. The couple have two children together, a son named Agnivesh and a daughter named Priya.

Signature/Autograph

Career

Early Business

During the mid-1970s, Anil Agarwal initiated involvement in the scrap metal trade by gathering materials from cable companies in different states and vending them in Mumbai. In 1976, Anil Agarwal, who was starting to be known as the “metal king,” purchased Shamsher Sterling Corporation, a company producing enamelled copper and other items, using a bank loan. In 1986, he started a factory that created jelly-filled cables and named it Sterlite Industries. Recognizing the fluctuating chance linked to making a profit after considering the costs of raw materials such as copper and aluminium, he opted to establish control by producing these metals himself rather than procuring them. [3]Forbes By 1993, Sterlite Industries achieved a milestone by becoming India’s first private sector firm to establish a copper smelter and refinery. In 1995, the company acquired Madras Aluminium, a previously non-operational entity under the Board for Industrial and Financial Reconstruction (BIFR) for four years. In 2001, Anil secured a 51% stake in the Bharat Aluminium Company (BALCO), a state-owned enterprise, for INR 551.50 crore. The following year, he acquired a controlling share (around 65%) in the state-run Hindustan Zinc Limited (HZL). [4]The Economic Times

Vedanta Group

Vedanta Resources has its headquarters in London and is a diversified global conglomerate in the natural resources sector. It has interests in various resources including zinc, lead, silver, copper, iron ore, aluminium, power generation, and oil and gas. Although its substantial assets are primarily in India, Anil Agarwal resides in London. In 2003, Anil Agarwal and his team established Vedanta Resources Plc in London as a means to access international capital markets. During its initial listing on the London Stock Exchange on December 10, 2003, Vedanta Resources Plc became the first Indian company to be listed there. In 2004, Vedanta Resources Plc unveiled a global bond offering and acquired Konkola Copper Mines in Zambia, Africa. In 2007, the company gained a controlling interest in Sesa Goa Limited, the largest producer-exporter of iron ore in India. [5]Business Standard In 2010, Vedanta Resources purchased a portfolio of zinc assets situated in Namibia, Ireland, and South Africa from Anglo American, a South African mining corporation. In 2011, Vedanta Resources attained a controlling stake in Cairn India, the leading private-sector oil-producing company in India. The merger of Sesa Goa and Sterlite Industries was declared in 2012, as part of the consolidation strategy of the Vedanta Group. In October 2017, it was revealed that Anil Agarwal’s Volcan Holdings Plc had acquired a 19% stake in the mining enterprise Anglo American, making him the largest shareholder in the company. [6]Moneyweb

Philanthropy

In 1992, Anil Agarwal established the Vedanta Foundation as the platform for overseeing the philanthropic endeavours of the group’s companies. During the financial year 2013–14, both Vedanta group firms and the Vedanta Foundation allocated a total of $49.0 million towards constructing hospitals, schools, and infrastructure, as well as environmental conservation and supporting community initiatives that enhanced the well-being of over 4.1 million individuals. These initiatives were carried out in collaboration with governmental bodies and non-governmental organizations (NGOs). Anil Agarwal’s philanthropic efforts focus on child welfare, women’s empowerment, and education. He secured the second spot in the 2014 Hurun India Philanthropy List due to his contribution of Rs. 1,796 crore (approximately $360 million). In 2015, the Vedanta Group, in collaboration with the Ministry for Women and Child Development, inaugurated the first “Nand Ghar” or modern Anganwadi centre, marking the beginning of a plan to establish 4,000 such centres. [7]Business Standard

Anil Agarwal has committed to donating 75% of his family’s wealth to charitable causes, inspired by the philanthropic approach of Bill Gates. In 2021, the Anil Agarwal Foundation pledged to invest Rs. 5,000 crore over 5 years in programs aimed at creating social impact, with a focus on areas like nutrition, women and child development, healthcare, animal welfare, and grassroots-level sports.

Controversies

Undue Favour Case

In April 2023, the Supreme Court upheld the 2010 decision of the Orissa High Court to revoke the state government’s move to acquire around 6,000 acres of land for a university, citing “undue favour” towards Vedanta Group. The 2010 decision by the Orissa High Court invalidated the land acquisition process initiated by the Odisha government and instructed Vedanta (then known as Sterlite Foundation) to return the awarded land to its original owners. The proposed university site, near Puri and a wildlife sanctuary and river, was established in collaboration with the Odisha government through an MoU signed in 2006. The court criticized the state government for favouring the Vedanta Group, asserting that the acquisition process and proposed benefits were caused by “favouritism” and violated Article 14 of the Indian Constitution (equality and equal protection before the law). A fine of Rs 5 lakh was imposed on the Anil Agarwal Foundation, previously known as the Vedanta Foundation, to be paid within six weeks. The Supreme Court noted that the initiation of land acquisition proceedings, including land selection, was driven by Vedanta (later renamed Anil Agarwal Foundation) rather than the state government. The court stated that there was a lack of consideration for environmental factors and rivers passing through the acquired land. It highlighted concerns over the proposed university’s impact on a nearby wildlife sanctuary, ecosystem, and ecological environment. [8]The Economic Times

Thoothukudi Massacre

The tragic event known as the Thoothukudi Massacre occurred on May 22, 2018, in Thoothukudi (also called Tuticorin), Tamil Nadu, India. During a peaceful protest opposing the expansion of a copper smelting plant under the ownership of Sterlite Copper, a subdivision of Vedanta Resources, the police fired upon the demonstrators. This resulted in the loss of 13 lives and injuries to numerous others. The people protesting wanted the Sterlite Copper plant to be shut down because they were worried that it was polluting the environment and making the people living nearby ill. The plant had been accused of polluting the air, water, and soil with harmful substances, posing severe health risks to nearby residents. Vedanta Resources, led by Anil Agarwal, acquired Sterlite Industries, which encompassed the Sterlite Copper plant, in 2003. The plant had a history of grappling with environmental and regulatory challenges, and protests against its expansion went on for several years before the tragic incident. The Thoothukudi Massacre drew significant attention to the actions of Vedanta Resources and its subdivision, Sterlite Copper. This prompted discussions about corporate accountability, environmental practices, and the responsibilities of businesses in ensuring the welfare of local communities. The incident triggered heightened scrutiny of Vedanta’s activities, adherence to environmental regulations, and corporate conduct, sparking debates concerning the balance between economic progress, public health, and environmental preservation. Following the incident and concerns expressed by local communities and activists, the government of Tamil Nadu decided to permanently shut down the Sterlite Copper plant in May 2018, due to environmental and public health considerations. The event also led to legal proceedings, public interest litigations, and investigations. The state government initiated an inquiry into the events leading to the violence and the actions of the police. The National Green Tribunal, a specialized environmental court in India, also intervened and ordered an evaluation of Sterlite Copper’s compliance with environmental standards. [9]The Wire

Awards, Honours, Achievements

- Anil Agarwal was named Ernst & Young’s Entrepreneur of the Year in 2008.

- Anil Agarwal received the Mining Journal Lifetime Achievement Award in 2009.

- Anil Agarwal received the Business Leader Award from The Economic Times in 2012.

- Anil Agarwal was given the Dr. Thomas Cangan Leadership Award in 2013 by the Faculty of Management Studies – Institute of Rural Management, Jaipur (FMS-IRM).

- Anil Agarwal was recognized as The Asian Awards’ Entrepreneur of the Year in 2016.

- Anil Agarwal won The One Globe Forum (OGF) award in 2018 for his contributions to creating a positive social impact in the communities where his group operates and for initiatives like Nand Ghar. [10]businessnewstrends.blogspot.com

- Anil Agarwal won The Asian Achievers Awards – Lifetime Achievement Award in 2019.

- Anil Agarwal was presented with the Asian Business Philanthropy Award in 2021.

- Anil Agarwal was given the CIF (Canada India Foundation) Global Indian Award in 2022, held in Toronto, Canada.

Net Worth

As per Forbes 2022 India’s Richest Net Worth, Anil Agarwal is worth $2.01 Billion as of 2022. [11]Forbes

Favourites

- Drink: Sattu kar Sharbat

Facts/Trivia

- Anil Agarwal follows a vegetarian diet. [13]Business Standard