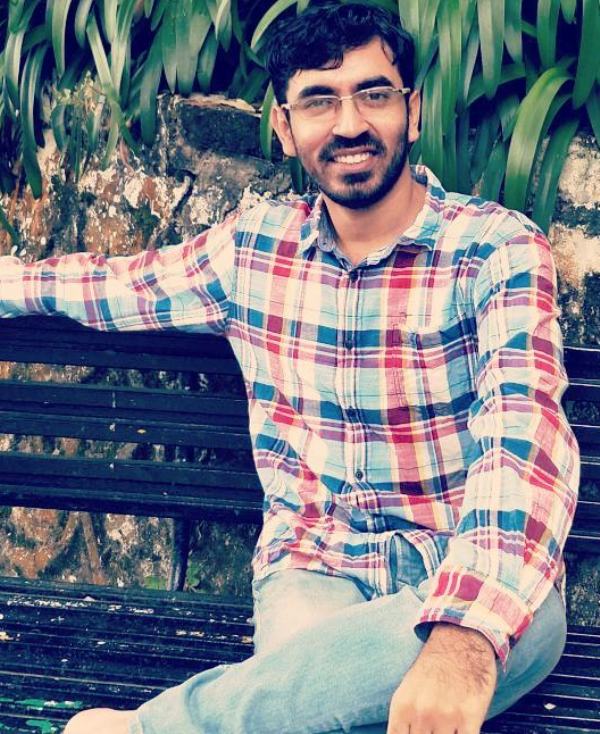

Pranjal Kamra is an Indian value investor, popularly known as the Investment Guru, who co-founded Finology Ventures Pvt. Ltd in 2018. He is also a YouTube sensation with millions of views on his videos related to the stock market.

Contents

Wiki/Biography

Pranjal Kamra was born on Tuesday, 16 February 1993 (age 28 years; as of 2021) in Raipur, Chhattisgarh. He completed his schooling at Holy Cross Senior Secondary School, Kapa in Raipur. He then pursued a Bachelor of Laws (2010-2015) at Hidayatullah National Law University, Raipur. Pranjal did a post-graduate programme in the securities market (2016 – 2017) at the National Institute of Securities Markets (NISM), Maharashtra. [1]LinkedIn

Physical Appearance

Height (approx.): 5′ 8″

Hair Colour: Black

Eye Colour: Black

Family & Caste

Parents & Siblings

Pranjal’s father’s name is Ravi Kamra, and his mother’s name is Madhu Kamra. His mother works at Durga Mahavidyalaya College in Raipur, Chhattisgarh. He has one sister, Priyanshi Kamra.

Girlfriend

Pranjal has been in a relationship with Priya Jain since 2008. Priya is a lawyer, and she is also the co-founder of Finology. Pranjal heads the finance department, and Priya heads the legal department of the company.

She is also a YouTuber and has a YouTube channel, Finology Legal. The channel has more than 780K subscribers as of 2020.

Career

Journey Through Law School

Pranjal was in the third year of his law graduation when he was introduced to the world of the stock market by his father who used to regularly watch shows related to stocks. He was intrigued by the working of the stock market and wanted to learn everything about it. While talking about his first investment in an interview, he said,

I casually asked my father for money to invest. He gave me Rs. 20,000 on the condition that I if I lose it, I would have to focus entirely on my Legal Studies. That very year my father had gifted me my first scooter, which was a TVS wego and I was totally in love with it. So due to this emotional attachment, I invested in TVS motors and beginner’s luck worked in my favour, in almost a year, the stock grew 10 times and the 4 thousand I had invested was now worth 40 thousand. I became overconfident and all the other stocks I bought failed miserably.”

He started reading about his idol Warren Buffett (an American business tycoon) in the fourth year of his graduation. He wanted to make a career in the finance sector, and he went against his parents’ wishes who wanted him to pursue post-graduation in law as he did a course in the securities market from NISM, the only institute in India affiliated to the SEBI.

Starting Finology

While Pranjal was studying in NISM, he was inspired to create an institution that provided novice investors with in-depth and unbiased knowledge about the stock market. He started Finology as a blog and a Youtube channel in 2017 due to a lack of monetary support. After struggling for six months with hardly any views on his channel, his 61st video went viral, and he became an overnight star. In 2018, Pranjal co-founded Finology Ventures Pvt. Ltd., a company that provides legal knowledge and financial toolkits to its customers. Finology is the first and only SEBI registered investment consultancy firm in Chhattisgarh. In an interview, when he was asked about his views on the right age to start investing, he said,

There’s a very simple answer to this question. There’s a living legend in the world of investing named Mr. Warren Buffett. He is great not just because of the fact that he has acquired humongous wealth, he’s great because of his investment journey. He started investing when he was just 11-years-old. And, now he’s 89. So, if you start at a young age, you keep evolving and you live long to reap the fruits of your investment efforts, you’ve made it in life! So, the perfect age and time to invest is NOW.”

Pranjal makes YouTube videos on trending financial subjects. His subscriber count on YouTube crossed 2.24 million in December 2020.

As an Author

As of 2020, Pranjal has written two business books, ‘Mint Your Money: An Easy Manual to Unlocking Your Wealth‘ and ‘Investonomy: The Stock Market Guide That Makes You Rich‘ (2020).

Facts/Trivia

- Pranjal has admitted that he was very underconfident during his school days. He was weak in his studies and often criticised by his teachers for his poor communication skills. This made him work on his fluency by reading newspapers, taking part in debate competitions and consistently improve his speaking skills.

- In an interview, he mentioned that the portrayal of lawyers in Bollywood movies led him to believe that the profession of law consisted only of delivering dramatic speeches. When he joined the Hidayatullah National Law University, he discovered that the maximum part of a lawyer’s job is research and not arguing in court. He soon lost interest in this field, which resulted in a decline in his grades. His rank was 131 in a batch of 145 students, and in his final semester, Pranjal was left with 25 subjects to clear in order to get a degree.

- Pranjal’s parents wanted him to pursue LLM. He lied to his parents that his CLAT (entrance test for LLM) centre was in Mumbai because he wanted to appear for the entrance test of NSIM.

- In an interview, talking about the risks involved in investing in the stock market, he said,

If you avoid certain disastrous things in life, good things will naturally happen to you, and it’s the same in investing. If you resist the temptation to be rich overnight and do not indulge in gambling activities like investing in penny stocks, sector funds, Intraday call, F&O, Currency & commodity derivatives etc. almost everything else will yield good results. Also, banks are commission-based distributors of financial assets, so avoid all investment products “Advised” by banks; they are literally bad for you.”